24+ Direct unsubsidized loan

Unsubsidized loans are available regardless of financial need. See the Direct Loan Interest Rate chart.

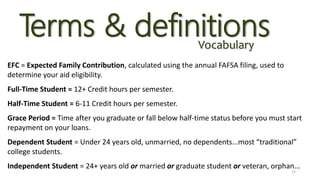

College Financial Aid Basics 2019 2020

Direct Loan borrower after Oct.

. Ad Plan Long-Term with Our Multi-Year Approval Benefit. For loans disbursed on or after July 1 2021 and before the July 1 2022 school year direct subsidized and unsubsidized loans carry a 373 APR for undergraduate students. Direct Unsubsidized Student Loan.

Federal Direct Unsubsidized Loan. A maximum of 23000 may be subsidized. Subsidized and unsubsidized direct loans.

Ad Help Cover College Costs and Get a Student Loan Without the Fees. Ad Competitive Interest Rates And Various Repayment Options To Fit Your Budget. Graduate students including PhD students can take out federal Direct Unsubsidized Loans to pay for their program.

Borrowers who meet that criteria can get. Ad Plan Long-Term with Our Multi-Year Approval Benefit. Apply In Just 3 Minutes To Get A Personalized Student Loan Instant Approval Decision.

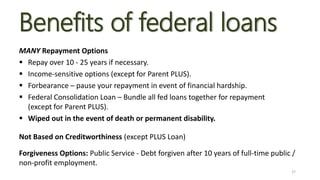

Unsubsidized Loans are available to undergraduates graduates and professional degree students. The standard repayment term on Direct Loans is 10 years. However you can qualify for a longer repayment term if you consolidate the loans or have more than 30000 in federal.

Refinance Student Loans For One Simple Payment That Fits Your Budget. On May 11 2022 the Treasury Department held a 10-year Treasury note auction that resulted in a high yield of 2943. A maximum of 23000 may be subsidized.

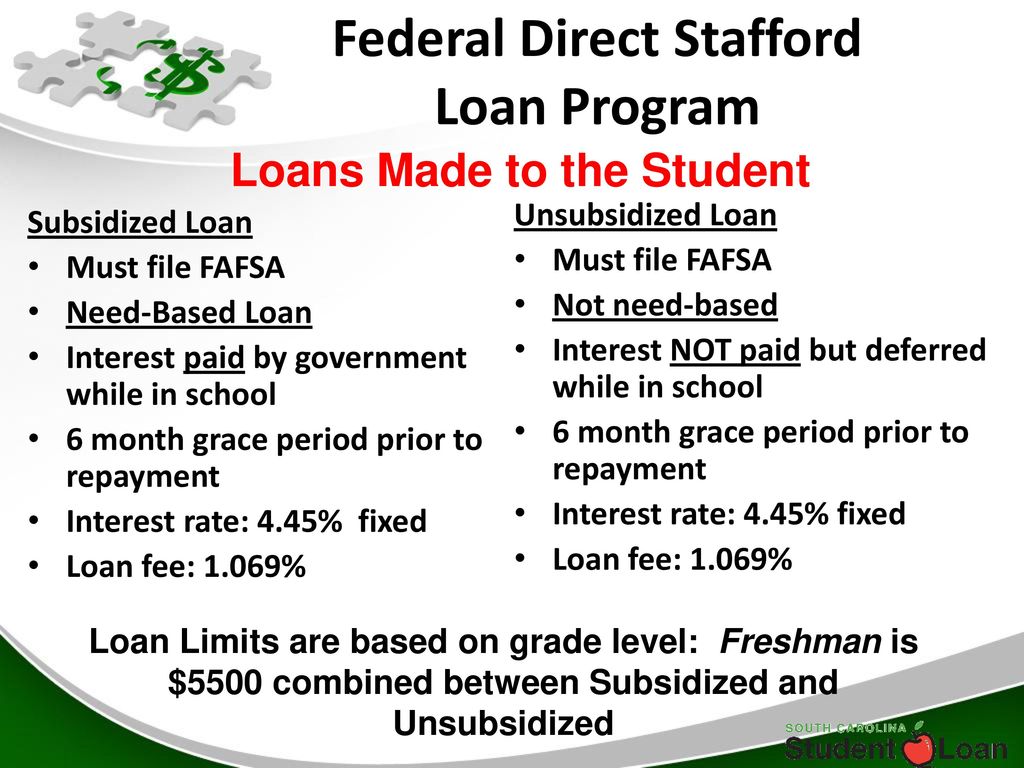

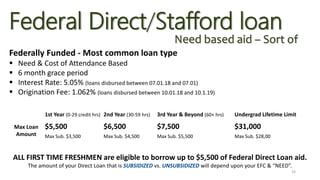

Direct Subsidized and Direct Unsubsidized Loans sometimes referred to as Stafford Loans. A Unsubsidized Loan is non-need-based and is. Easy Application Process Multi-Year Approval No Payments until Graduation.

Overview of the Direct Subsidized Loan. Rate APR 499 for undergraduates. Navigate Grad School With A Tried And True Partner.

The chart below shows the interest rates for Direct. Supporting You Every Step Of The Way. 375 APR to 1338 APR For Graduate Loans w Autopay Discount.

Federal Student Aid. O The fixed interest rate on this Federal Direct Unsubsidized Stafford Loan percent is 499 for all US. The federal government subsidizes this type of loan by paying the interest that accrues while the student is enrolled at least half-time and during qualifying periods of.

As unsubsidized loans your interest will accrue. Get Instantly Matched with the Ideal Student Loan Options For You. Interest on Subsidized loans is paid by the federal government while the student is in school.

The graduate debt limit includes Direct Loans received for undergraduate study. Ad Get Instantly Matched with the Best Loans For Students in USA. The interest rate on loans.

Federal Student Aid. To be eligible for forgiveness you must have federal student loans and earn less than 125000 annually or 250000 per household. O Federal loans are not grants.

Get Cash Rewards for Good Grades. An unsubsidized loan formally known as a direct unsubsidized loan is a form of federal student loan available to both undergraduate and graduate students who meet the. You may make repayments while enrolled in school.

Complete Your Application Today. Our Reviews are Trusted by 45000000. Great Rates Zero Fees.

Ad 10 Best Student Loan Refinance Companies of 2022. Graduateprofessional students are not eligible for this. I must repay this debt and all interest it accrues.

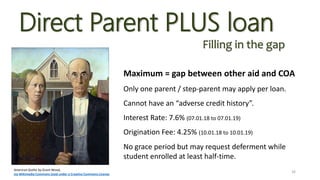

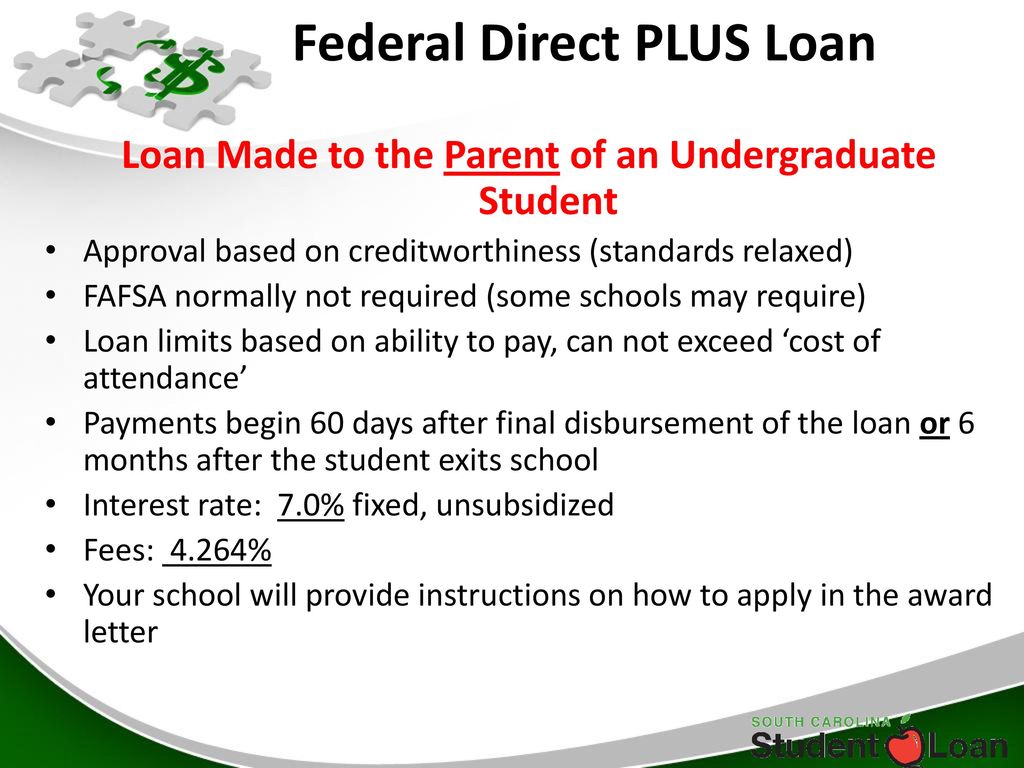

For Direct Subsidized Loans and Direct Unsubsidized Loans when the first disbursement of the loan is made after October 1 2020 and before October 1 2021. Also known as Federal Stafford loans both subsidized and unsubsidized loans are awarded by the federal government to eligible students who are. The 2019-2020 federal student loan interest rates are currently 453 for undergraduate loans 608 for unsubsidized graduate loans and 708 for direct PLUS loans.

Complete Your Application Today. Stafford Loans were a type of loan students could borrow from the federal government to help pay for their cost of attendance in college or at a trade school. Easy Application Process Multi-Year Approval No Payments until Graduation.

There are two basic types of Federal Direct Loans. In addition the total Federal Direct Subsidized Loan and Federal Direct Unsubsidized Loan cannot exceed your annual maximum loan limit. 654 for graduates and professionals.

However interest will begin to accrue upon receipt of your loan funds. Both have a 6 month grace period a period of time when a student is no longer enrolled for at least half-time.

Paying For College College Ppt Download

College Financial Aid Basics 2019 2020

Paying For College College Ppt Download

Understanding Student Loan Interest Rates Infographic Via Younginvincibles Com Student Loan Interest Student Loans Loan Interest Rates

Paying For College College Ppt Download

College Financial Aid Basics 2019 2020

College Financial Aid Basics 2019 2020

College Financial Aid Basics 2019 2020

Paying For College College Ppt Download

Pin On Money

Paying For College College Ppt Download

How To Read Your Student Aid Offer Letter 5 Examples Nitro Financial Aid For College Financial Aid Federal Student Loans

College Financial Aid Basics 2019 2020

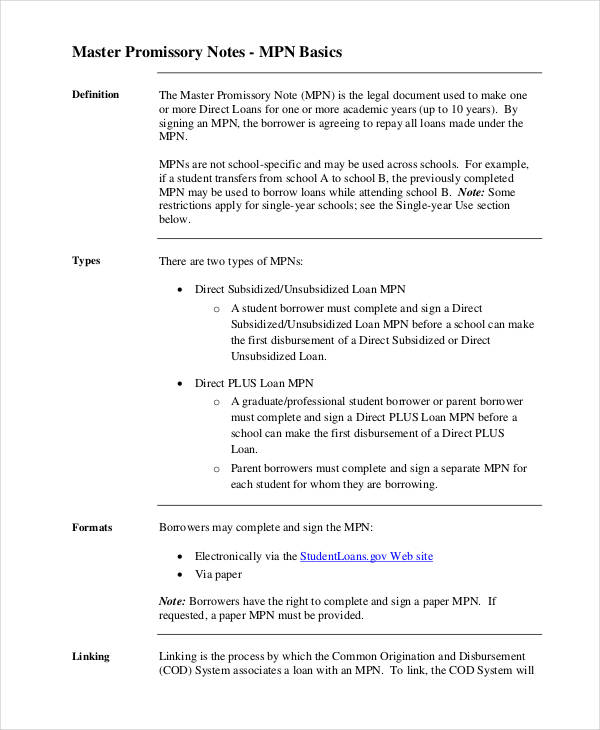

Free Note Examples 31 In Pdf Doc Examples

2

2

How To Find Your Student Loan Balance Forbes Advisor